We hear it all the time. “You need [insert amount here] to retire!” Some of the numbers I have heard along my journey to financial independence have been pretty reasonable, but most quite laughable. One million, two million, even ten million dollars are some of the figures that I’ve read or heard about when it comes to how much I need to retire. That was before I got introduced to the 4% rule, the financial independence community and the simple math that will prove to you what I have learned: that the amount of money you need for retirement is much, much lower than what the media promotes.

Let me go ahead and make a very important disclaimer: consult with a financial professional before you make any serious decisions with money. No podcast, blog or single article should ever be the final call for your financial future.

Trinity Study and Retirement Portfolio Success Rates

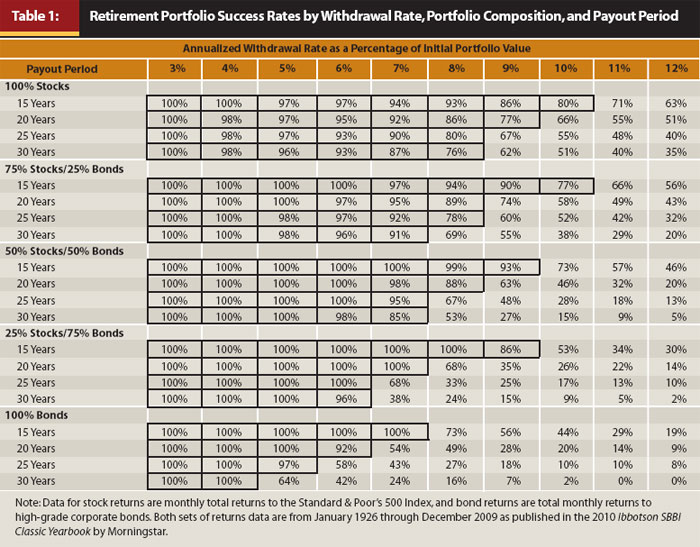

To give you a brief history lesson, three professors from Trinity University in Texas got together in the early 90s and researched withdrawal rates from different portfolios of stocks and bonds. They wanted to see how long the money invested in different ways between stocks and bonds would have lasted in the past. This might have very well been the greatest personal finance discovery ever. Right there with John Bogle’s creation of the first index fund.

As you can see in the updated study below the data looks at different lengths of time over different periods from 1926-2009. Obviously past performance is not an indication of future earnings, but look at the historical data and tell me you don’t find this very interesting at the least. That past investment portfolios when allocated appropriately have a 100% success rate of surviving economic recessions, wars, and all kinds of terrible events.

Now the most successful and promising portfolios have been composed of 50% stocks and 50% bonds and for more details on that you can certainly check out the latest update to this study. You can thank me later for that one.

The Unofficial Amount of Money You Need for Retirement

Here’s the fun part I love. The math. OK, the “future you” will begin retirement someday and the “present you” wants to make sure your investment portfolio is set up for success. Personally, I like the idea of having 50% stocks and 50% bonds in retirement since this is the most successful, long term investment portfolio as the research shows. So, we’ll use this as our example. In order to make this work for you you’re going to have to first figure out your safe withdrawal rate or how much you plan to spend per year in retirement. Ideally, you want to be DEBT FREE including the house by the time you reach retirement. This is important, because the less debt you have the more money you have working for you and sustaining your retirement for the long haul.

Let’s say your number for yearly expenses is $30,000 . You then look at the table above and check for the 30 year period for the 50/50 section. According to the research your safe withdrawal rate will be no more than 5% of the total amount of money you need for retirement or $600,000. Take $30,000 and divide it by 5% and that gives you $600,000. This nest egg breaks down to $300,000 in large common stocks such as an S&P 500 Index fund and $300,000 in high-grade corporate bonds.

Wait?! What?! “You mean to tell me I can retire with $600,000 if I only spend no more than 5% of that per year and that should last me 30 years?” According to the research, “Basically, yes.” Every year you have to adjust the amount of your withdrawals for inflation, but I have a feeling you and your financial advisor can manage to figure this part out very quickly.

What the 4% Rule Really Means

Just so you know, the financial independence retire early (FIRE) community and other financially optimized communities generally accept a safe withdrawal rate of 4%. This is because we want our money to last more than 30 years and with further research by more scholars, 4% is what just about all the financial communities agrees is a good number to work with during your retirement. In our $30,000 example, that would require a nest egg of $750,000 or $375,000 stocks and $375,000 bonds.

To make this 4% rule work:

- Truly consider the amount of money you need per year in retirement.

- Be and stay debt free including the house.

- Continue to budget.

- Have a good financial advisor who can keep you calm during the ups and downs of the market.

- Enjoy life, you earned it.

The 4% Rule After 30 Years

The Trinity Study looked at 30 year periods and less, but like me you probably want to know about after 30 years. As I was studying the data I became interested in 40 and 50 years of retirement. Well, you don’t have to worry. If you can adjust your spending to 3% of your nest egg then you can almost be sure that your money will out last you and you’ll have some left to pass on to whoever you want. So, in the $30,000 example we would divide by 3% and get $1,000,000. That my friends could very well be all you need if you can be smart and financially responsible. I have a feeling you will.

One thing is for sure, unless you plan to spend $100,000/year in retirement you shouldn’t need more than a million dollars to retire with. You just have to decide for yourself if living a modest lifestyle is worth the extra years of financial independence. There are going to be other factors you will need to consider, like healthcare and college education if you have children. Research the data, talk to a professional and figure out the real amount of money you need for retirement. Don’t just go with what the media who knows nothing about you says you need!

Importance of Financial Advisors for Your Retirement

I think one dedicated article on working with financial advisors should be added to the list for this year. There is an important role a financial advisor can play when it comes to planning and preparing your retirement. The amount you need for retirement is not the only factor to consider. You need a plan and goals on what your retirement is going to look like. This is where spending a few hours with a professional will have value.

As much as I am a huge D-I-Yer, I strongly advise you talk to a financial professional to help explain safe withdrawal rates and other complex topics discussed in this article. These can be very difficult concepts to grasp and a professional can help you understand while considering your unique and specific financial situation. This article is simply not enough, but it is something to help you kick-start your goals and future plans. Even I make sure to consult professionals in these matters so I don’t make big, costly mistakes.