Let’s get one thing out of the way. By now you already know to get your investing game going. No matter how old you are, starting today is critical to building your wealth thanks to compound interest. With so many ways to save and invest I definitely understand this can be a little intimidating. So let’s talk about one way to save and invest your money for the long term. I introduce you to Roth IRA (Individual Retirement Account), one of my favorite investing buckets.

What is a Roth IRA?

Most of you are probably familiar with a 401(k) or 403(b) as they are the two most talked about types of retirement savings accounts. Little did you know there are a lot more different retirement savings accounts out there that can help you save and invest even more. In this article we’re going to talk about only the Roth IRA. Don’t worry, I plan to introduce to you all the other ways to save and invest in tax-advantageous ways.

A Roth IRA is an IRA that allows earned-income qualified individuals to save up to a specified limit set by the wonderful government of the USA. “The Roth IRA was established by the Taxpayer Relief Act of 1997 (Public Law 105-34) and named for its chief legislative sponsor, Senator William Roth of Delaware” (thank you Wikipedia). The key attribute of Roth IRAs was that the contributions made by a qualified individual would be with after-tax dollars. So, if you qualify to have a Roth IRA then any dollars you have laying around can be used to fill up a Roth IRA.

How Much Can I Save Per Year?

As of 2019, a qualified individual can contribute up to $6,000 per year and $7,000 if the individual is 50 years old or older. This is not a lot compared to 401(k) and 403(b) limits, but as you will read below there are tax advantages that make up for the low contribution amount.

Do I Qualify for a Roth IRA?

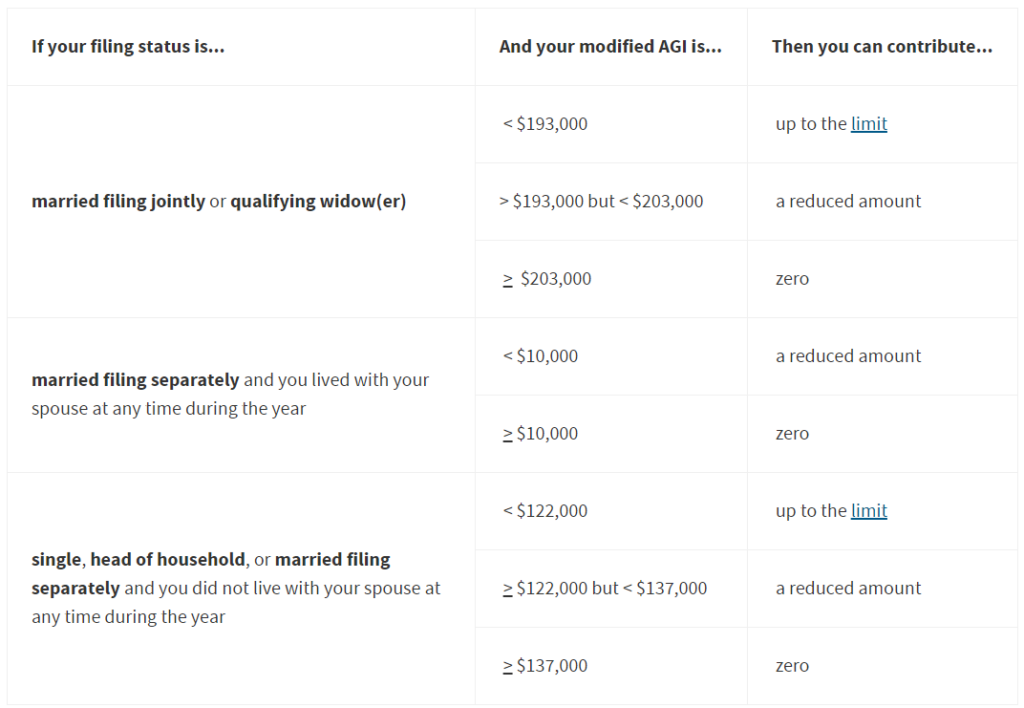

To be eligible to contribute to a Roth IRA you have to meet certain income requirements. Let’s review the requirements below from our lovely IRS. As you can see below once your income reaches a certain amount you are no longer eligible to contribute to a Roth IRA. Don’t worry though, we’ll go over how to contribute to a Roth IRA even if you don’t qualify per below.

What About Taxes?

One of the benefits of a Roth account is that you’re contributing with after-tax dollars. You’ve already paid taxes! So, the money in your Roth IRA grows tax-free and when you get ready to withdraw you don’t have to pay any taxes on the contributions or growth (assuming you’re clear to make withdrawals without penalties). This is not how 401(k)s and Traditional IRAs work. You pay taxes on your withdrawals. With a Roth IRA you don’t pay any taxes on withdrawals from what you contributed or the growth. This is true as of 2019. All the research I’ve done says there is a small chance the government could change this. However, this is very unlikely as politicians typically wouldn’t want to do anything to lose support. Make sure you check with a tax professional.

How to Open a Roth IRA

Pretty much any brokerage company. Vanguard, Fidelity, Charles Schwab to name a few. Really take the time to consider what you’re looking for from a provider. I personally plan to open my Roth account with Vanguard. My 401(k) is already with Fidelity so why not mix things up a little. Plus, I’m very interested in opening a retirement account with Vanguard (low fees and excellent reputation in the FI world).

What if My Income is Not Eligible? (Hint: google “backdoor Roth”)

It is true that some of you make more money that makes you ineligible to have a Roth IRA. This is where the “back door Roth” strategy enters. A Traditional IRA doesn’t have any income restrictions and if you do this right, you can fund a Traditional IRA with after tax dollars and convert what you put in the Traditional IRA into the Roth IRA. This is can be a complicated transaction, especially if you have other IRAs. I highly recommend you seek professional help for this conversion no matter what. Your provider should be able to help you. I can personally attest that the customer service at Charles Schwab and Fidelity are awesome. Just for you to be prepared with, here are the basic steps you follow:

- Open a Traditional IRA and fund it with as much as you can up to the maximum ($6,000 or $7,000 if you’re 50 years or older).

- Then contact your plan administrator and ask them to transfer what you just contributed into the Traditional IRA into the Roth IRA. Make sure to convert the funds immediately, because if there are any gains then you will have to pay taxes on those gains.

What if I Have an Emergency?

You can withdraw contributions you made into a Roth anytime tax and penalty free. This is because you’ve already paid the taxes remember. Any growth and earnings however may be penalized depending on when you withdraw. This is still good to know that you can take the money you contributed anytime you need.

Should I Open a Roth IRA?

Having a Roth IRA can be a really good inheritance to leave loved ones or any beneficiary you name. This is because your beneficiaries do not pay income tax on distributions as long as you’ve held a Roth account for more than 5 years. Also, your beneficiaries cannot just let the money sit there. They will have to make required minimum distributions, but that’s OK. Your beneficiaries will have a good source of income to do with what they want. Hopefully good choices. For more information on beneficiary rules visit this link.

Also, unlike most other retirement accounts Roth IRAs don’t force you to take minimum distributions at age 70 1/2. The money you invest in a Roth can keep growing and growing and growing. You get the point. Another reason Roth accounts are great for passing on.

If you have the ability to do so, open up a Roth IRA as soon as you can. There’s a 5 year window that can affect some of the things you can and can’t do. Don’t worry we’ll talk more about Roth IRAs in the future, because there is so much more to know. If you have any questions feel free to ask below or contact me through our Contact Us page. I still highly recommend you speak to a professional about Roth IRAs. If your financial situation allows, you can definitely benefit from having a Roth IRA.