“How do I get started with investing?” This is a question I get from time to time. There is no clear cut, one-way answer to this. Real estate or owning a small business is not for everyone. Remember, personal finance is personal. And still I believe that everyone who’s just starting to invest can benefit from having this one low-cost index fund in their portfolio. I would also suggest this to anyone who doesn’t have this great investment in their portfolio. You already know the 3 rules of investing I follow. Now I introduce you to the Total U.S. Stock Market Fund. This is simple index investing. You own a small piece of every publicly traded U.S. based company. This means you get the large companies like Apple, Amazon, Microsoft, Alphabet (Google), Exxon Mobile all the way to the small companies like Viacom Inc. Class A, bebe stores inc., and Houston Wire and Cable.

“Ok Matt, what does this mean exactly and how do you start investing in this index fund?” Well, that’s what we’re going to talk about here. Also, note this article is written with the understanding you have access to a 401k, 403b, IRA, or other type of tax-advantaged savings account. If you need help with this I highly suggest you read my past blog on saving for retirement. And you can even have index funds in regular, taxable brokerage account. I suggest this for anyone who’s already maxing our retirement savings accounts including HSAs (click here to learn more about Health Savings Accounts).

What Are Index Funds?

First you need to understand what a mutual fund is. A mutual fund is “an investment vehicle made up of a pool of moneys collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and other assets.” Index funds are mutual funds that track an index such as the S&P 500, NASDAQ, Dow Jones Industrial Average and others out there all over the world in different forms and names. You have all these different companies that monitor and analyze a specific group or class of companies called an index. And the index fund you invest in through companies like Fidelity, Vanguard and others automatically follows that index respectively.

For example, let’s take the S&P (Standard and Poor’s) 500 index, a close relative of the Total U.S. Stock Market fund which I also like. This index consists of the 500 largest U.S. companies like Amazon, Apple, Microsoft, Under Armour, and Chipotle to name a few. So this index is out there already. Companies like Fidelity, Charles Schwab, and Vanguard simply offer you the ability to invest in this index through them. Index funds are typically low in fees, because there isn’t much work being done by the brokerage companies. The homework has already been done. This is great for long term investing and saves a lot of money on taxes since there isn’t a lot of trading going on within that fund.

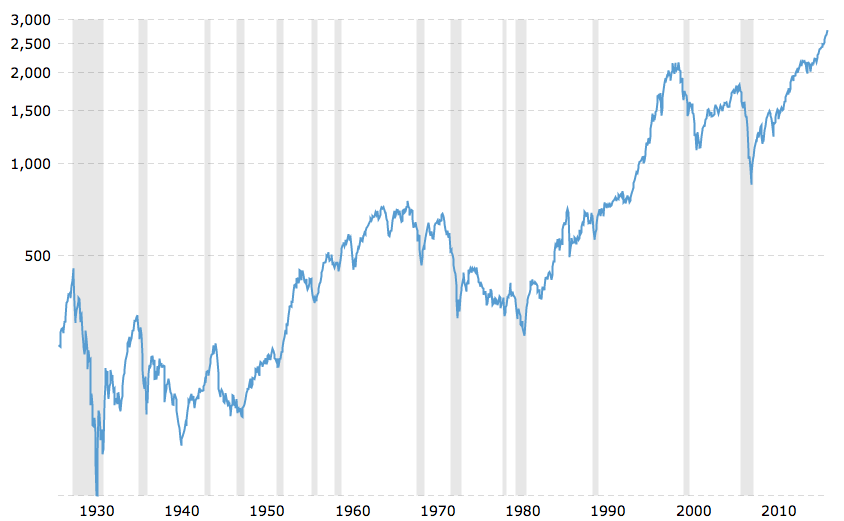

Check out the performance of the S&P 500 index in the last 90 years. While there have been times of severe lows the overall performance has been positive! The research has been done that supports long term, 15, 20+ years of investing. The longer your invest the more wealth you build. There’s a reason why Warren Buffet wrote in his will for 90% of his money to be put in a low-cost S&P 500 Index Fund (preferably Vanguard) and the other 10% in short-term government bonds.

What About Fees?

Here’s one of my favorite parts about index funds: the fees. Typically you’re going to find some of the lowest fees with index funds in tax and non-tax advantaged accounts. I want you to take a look at my favorite index fund, VTSAX and check out the “expense ratio.” It’s .04% or also can be stated as 4 basis points. This means at the end of the year your account is going to be charged .04% of whatever is in there. That’s pretty low which makes for more of your money coming back to you! When you invest outside of index funds into what’s called actively managed funds you can sometimes find that you’re paying 1% or 2% in fees. That is a ginormous amount when you consider the long term impact.

I’ll discuss expense ratios and long term cost another day. For now, just try to find index funds where the expense ratio is lower than .10% maybe .20%. There’s no reason to pay anymore. Today so many companies offer low fees you won’t have a problem with this. Then again, I’ve seen the investment options and fees in my wife’s company’s 401k and I cringed a little.

So Which Index?

I kinda gave it away in the previous paragraph. Vanguard’s VTSAX is great if you can afford the minimum $10,000. If not, Vanguard offers the same investment with a slightly higher expense ratio of 0.15% and a minimum initial investment of $3,000 in VTSMX. However, if you can’t do either of these then check out Charles Schwab’s SWTSX. I personally have 75% of my portfolio in FSKAX (previously FSTVX), because my 401k plan through my job is with Fidelity. If I had the choice and capital I would definitely go with VTSAX or save enough through Schwab’s SWTSX and move over to Vanguard once I accumulated $10,000. You can see below the performance of Vanguard’s Total Stock Market Index fund since 1992 (it’s the blue line). The U.S Market has always done well over the long term.

VTSMX was created in 1992 and the slightly lower cost VTSAX was created in 2000. Let’s say you invested $100/month in VTSMX since 1992 through and staying diligent through the ups an downs of the market. The tech bubble in the early 2000s and one of the worst recessions in 2008/2009. Today after about 25 years of investing you would have about $140,000 and only $31k was what you contributed! Suddenly that $30k car you’re thinking about financing is not looking so good. And for fun let’s take a $400/month car payment and see what that would have turned into with a VTSMX/VTSAX fund: $555,000 and you only put in about $125,000. Obviously, these numbers don’t take into inflation which is why these are estimates, but I think you get the point.

Of course if you find that you like Charles Schwab, Fidelity or someone else over Vanguard, that’s perfectly fine too! Some of you may like the convenience of an actual office you can go into and talk to someone. Both Fidelity and Schwab have physical locations all over the U.S. Vanguard not so much, yet. This is your money and your future and I want you to feel comfortable with who and what you invest in.

One Fund, Really Though?

Pretty much. You start with this one fund and build from here. After a while you’ll start to learn the basics of simple index investing along with phrases like “asset allocation” and “re-balancing your portfolio.” You need to understand that the most important key to investing is to get started. $100/month, $200/month, or $1,000/month. Time and compound interest are forces that can work for you if you start early.

This one fund is a great way for any beginner investor to enter the world of saving and investing for the future. This is why I don’t invest in single stocks. I get the benefit of having every U.S. company and hundreds of other companies around the world in two or three simple index funds. And if you’re retirement plan doesn’t offer this fund, check to see if the S&P 500 Index Fund is a choice. Usually this is the Index Fund that’s available in most company sponsored retirement savings plans. These two funds are very closely related.

How to Invest in Index Funds

Start by looking into what retirement savings account you are eligible for: Roth IRA, Traditional IRA, SEP IRA, 401k, 403b, etc. Then choose a brokerage company you want to begin investing through. Like I mentioned I’m only familiar with Vanguard, Charles Schwab and Fidelity. Each company has it’s pros and cons, but you can’t go wrong with choosing any of those three. And if you’re not happy with one company you can lways transfer to another company. I’ve done this process and it’s very easy. Also, if you can’t sign up for one of these tax advantage savings account, I still recommend investing in a taxable account and having these tax friendly index funds to minimize how much you pay in taxes year over year.

Remember, time is of the essence when it comes to investing. And if you haven’t read my article about my rules of investing make sure you check it out here. If you have any questions don’t be afraid to ask. There are no dumb questions when it comes to investing…only dumb investments. Follow this education on simple index investing and you’ll be fine.