Usually around this time there are many students graduating from high school all over the nation. As parents we have one common concern with what happens after. How will our children pay for college? From scholarships to student loans it seems there are so many different ways to tackle the ever-increasing costs of college.

Luckily, for residents of the state of Georgia we have a great option to help us be financially prepared. As of right now my wife and I are using the Georgia Path2College 529 plan to save for education and if you’re a resident of Georgia you may want to start too. To see how our Georgia 529 plan is doing scroll down to the end. I’m a big believer in being transparent along this journey to financial independence and that includes our mission to save for college.

What is a 529 Plan?

A 529 plan is a tax-advantage savings plan designed to help save for future educational costs. 529 plans are offered from state to state and you can choose any state’s 529 plan to save with and pay from, no matter where you or where your child goes to school.

There are other ways to save for college and education, but for this post we’ll focus on the Georgia Path2College 529 plan. Since we are residents of Georgia and I’ve received a request for this type of post I think you will find the information in this post pretty useful.

One great feature of a 529 plan is that there are no income restrictions unlike the Coverdell Educational Savings Account. This is why I’ve grown to like the 529 plan. Also, 529 plans can easily be transferred to another person. It’s very flexible in how and who can use the funds as long as the expenses meet the IRS guidelines for qualified nontaxable distributions.

Don’t even think about using the funds in the 529 plan for anything except education or else you will pay a lot of money in taxes and fees! Just ask your tax adviser.

Georgia Path2College 529 Plan

The Path2College 529 plan offered by the state of Georgia is not the most highly ranked 529 plan out there, but Morningstar does consider Georgia’s Path2College 529 plan “Silver-Rated” which is second highest in a possible 5 rating system. For residents of Georgia this can serve as a great tax benefit as we will see later. I definitely recommend all Georgia resident’s to at least give the Path2College plan a look if you’re thinking about saving for your child’s education.

Registering for a Path2College 529

Setting up a Georgia Path2College 529 plan is actually pretty simple. Go to www.path2college529.com, click on “Open An Account”, select the type of investment you want to have in the account and start funding it. The process of establishing a Path2College 529 plan for your child shouldn’t take more than 30 minutes to an hour.

Great thing about the Path2College 529 plan is that anyone can contribute to your child’s account. So at your child’s next birthday or Christmas you can just direct family and friends to visit a link provided by the plan where they can contribute whatever amount they choose. They click on the link and make a contribution using a special eGift code tied to the account. This is a great feature of the plan that we definitely will try in the future.

We did this in 2018 for a family friend and it was super easy. My cousin gave me her son’s eGift code and I simply went to the Path2College site and made my 529 contribution. Very simple.

Georgia Path2College Investment Options

The Georgia 529 plan Path2College comes with some decent options for investments. Let’s go over the different investment choices you have available to invest your contributions in.

- Age-Based Investment Options – These are funds that are invested in a way that match the age and time your child has until the funds will be used. For example the 0-4 years option will be invested more aggressively than the 18 year option. This is because at 18 years old your student will start using the funds for college and doesn’t need volatility or high risk.

- Guaranteed Investment Option – This is an option for those who don’t trust or have faith in the stock market. With this guaranteed option, “the minimum effective annual interest rate will be neither less than 1% nor greater than 3% at any time.” So you can’t do any worse than 1% and no better than 3% each year. While this may be safe, you could potentially lose out on so many gains that compound interest would have made for you in a fund invested in stocks and bonds.

- Multi-Fund Investment Options – There are two choices in this category. One is a balanced fund with 50% stocks and 50% bonds. The second choice in this category is made up of several types of bond funds. We use the first choice in this category for our little one, the Balanced Option. Personally, this is a style of investment we are comfortable owning for the next 18 years no matter what the market does. There is a balance of different types of bonds to smooth the down times of the market.

- Single-Fund Investment Options – All you need to know for the two options in this category is that you can invest 100% of the money in stocks or have the money in a money market type of investment making about 1% interest. These two funds are not particularly very attractive, because of what this savings account is meant for. You want to save as much money as you can for education with minimum risk involved.

You can research all the investment choices here to learn more about your options. Remember to consult a financial adviser if you want professional advice.

How Much Should I Save?

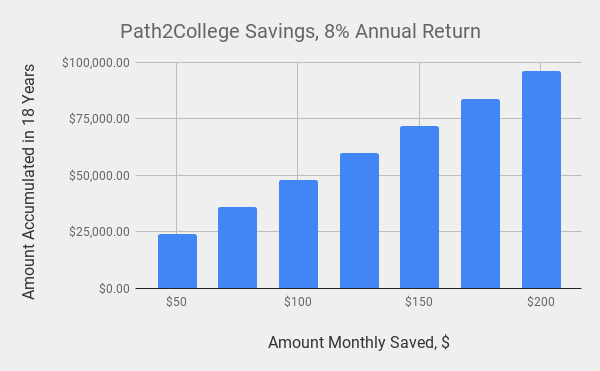

How much you should save really all depends on your current financial situation. Do you have other debt that you need to take care of first? I recommend starting with about $50-$100/mo. At least if the little one goes to an in-state college she’ll have a decent amount of funds to tap into and saving that amount of money doesn’t hurt your pockets too much. Just to give you an idea if you started saving $100/month from the time the little one was born to the age of 18, with a return of 8%, you’d have about $48,000. Even with a 6% return you’re looking at almost $40,000. Don’t tell me your child can’t get a good college education with that!

Georgia 529 Plan Deduction 2023

One great reason to have the Path2College 529 plan if you’re a resident of Georgia is for the tax benefit. While there is no federal tax deduction with 529 plans, there is a state tax deduction for Georgia residents only if you make contributions to Georgia’s Path2College 529 plan. Effective January 1, 2020 for 2020 tax year and beyond, contributions are deductible up to $8,000 per year per Beneficiary for joint filers, and $4,000 per year per Beneficiary for all others. This can be a great way to shelter some money that would otherwise be owed to the state. Not to mention you’re saving for your child’s education!

529 Plans Only for College?

For a long time 529 plans could only be used in tax-advantageous ways for college. Recent law changes have opened the opportunities to use the money in 529 plans for “tuition in connection with enrollment or attendance at an elementary or secondary public, private, or religious school.” You can use up to $10,000 from the plan every year to pay for those costs. In essence, the 529 plans have become the ultimate way of saving for your child’s education. If you’re a Georgia resident then having a Path2College 529 plan can only be a positive benefit. Even if you only contribute the $4,000/$2,000 max amount Georgia allows you to deduct from, that’s still money you get to save.

Our Georgia 529 Plan Performance (Updated January 2023)

Like I mentioned earlier in this post, transparency is important to me and I’m sure it’s important to you. In order for you to feel confident in what I write and speak about, I have to lead by example! We started saving in the Path2College 529 Plan in November 2017 and we’ve seen a little progress thus far. So, as often as I can I’ll be updating the below performance for you all to review so that hopefully you’ll be inspired to save for your child’s education.

Update 1/19/2023 – The market ended the 2022 down and we have not been able to contribute to the 529 plan since the May 2021 update. Since May 2021 the account is down $74.28.

| Date | Net Contributions | Earnings | Total Amount |

| Oct-2018 | $650.00 | +$21.99 | $671.99 |

| Dec-2018 | $650.00 | -$33.14 | $616.86 |

| May-2019 | $650.00 | +39.26 | $689.26 |

| Jan-2020 | $650.00 | +$102.78 | $752.78 |

| May-2021 | $950.00 | +$251.13 | $1.201.13 |

| January-2023 | $950.00 | -$74.28 | $1,126.85 |

What are your thoughts fellow Georgians? How are you dealing with the cost of college and education as a whole? What are your experiences with the Georgia 529 plan?

Don’t forget to subscribe to my newsletter and get the latest updates on our Georgia 529 plan performance and other personal finance information.